Plan Modeling

The core element of our planning process is a computer generated model of your financial life that uses sophisticated predictive techniques (Monte Carlo Simulation randomizing both annual investment returns and mortality) to analyze the viability of various planning strategies. The model, once fully developed, serves as a test bed that will be used for analyzing the various financial decisions that you face from time to time. This model is archived and is revised at each scheduled review and whenever a new financial question arises.

The model allows our clients to answer the question: “Given my current assumptions, goals and resources, what is the probability that my plan will succeed?” In this case, success is defined as the ability to support your financial goals throughout your lifetime without depleting your investment portfolio below a predetermined level. This probability is determined by running thousands of simulations of your lifetime and tracking the number of successful outcomes versus the number of plan failures. During each simulation, the model funds your stated goals while varying your life expectancy and the annual investment return earned on your portfolio.

These simulations expose the vulnerability of a plan to the coincidence of unfortunate sequences of annual investment returns and unusually long lifetimes. When confidence in a plan (a specific package of goals and assumptions) proves to be unacceptably low, the key variables can be adjusted, in concert, to produce the needed improvement. This rigorous “stress testing” and adjustment ensures that your plan can be relied upon to deliver the results you expect. Repeating this process periodically makes sure that your plan stays on-track over the years.

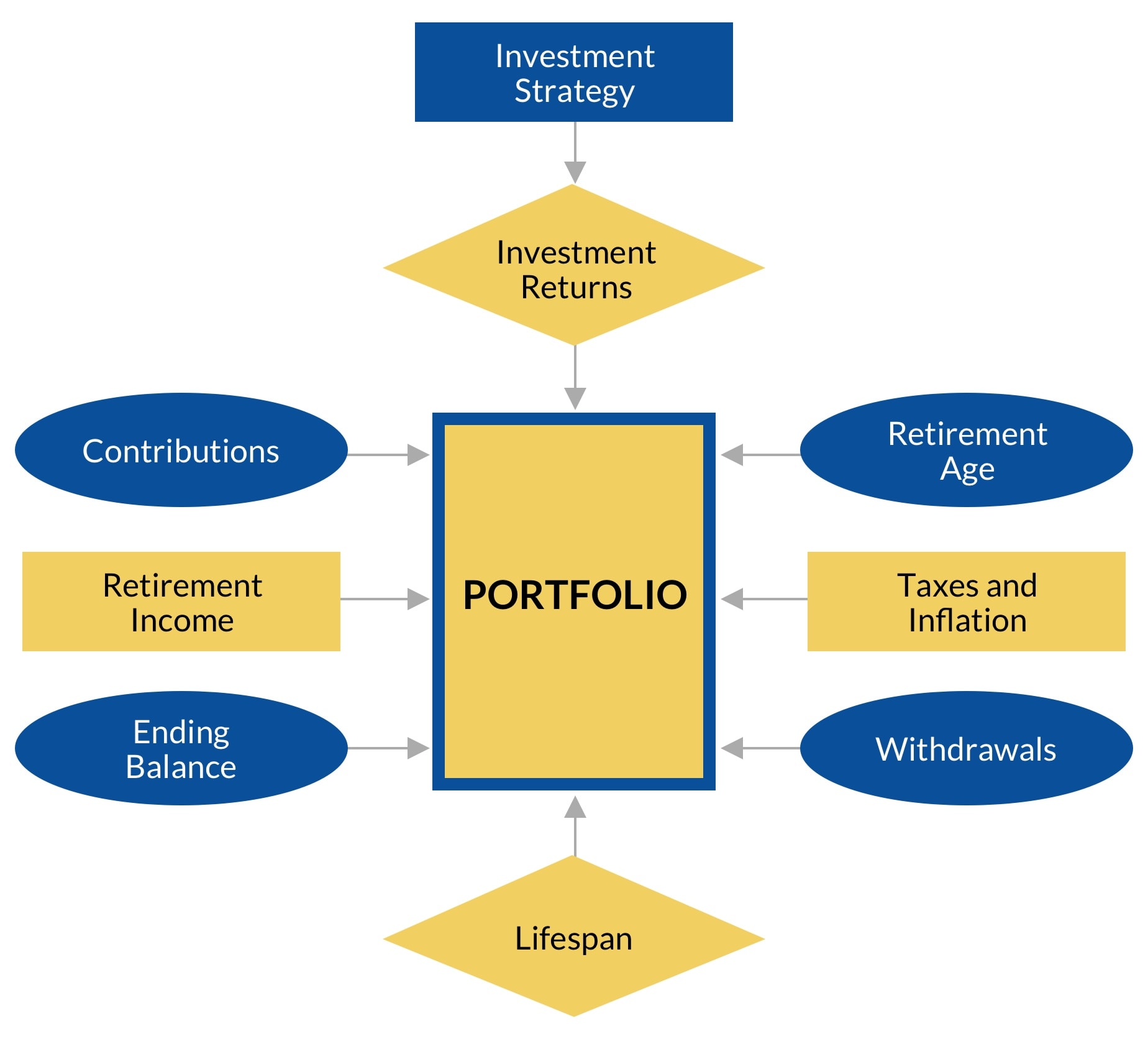

Portfolio.

Your portfolio consists of your savings and any other assets that will be freely available to support you in retirement. The object of the modeling process is to invest this portfolio in a way that will provide any funds needed to meet your needs and sustain your plan while minimizing the amount of investment risk to which you are exposed. This variable is circumstantial and not under the control of the client.

Contributions.

Contributions to your portfolio include most inflows to the Portfolio from outside sources. Things like regular savings deposits, IRA contributions and employer sponsored plan contributions are covered here. Contributions also include special inflows like inheritance amounts, gifts and life insurance proceeds. This variable is, within limits, under the control of the client.

Retirement Age.

If you are still working, your retirement age will have a significant impact on your financial plan. It can indirectly affect other variables through changes in such things as Pension and/or Social Security benefits, savings and spending rates, and lifestyle changes. This variable is, within limits, under the control of the client.

Retirement Income.

Your retirement income comes from sources other than your portfolio. Pensions, Social Security benefits, part-time work, gifts and inheritance can be accounted for here. This variable is typically circumstantial and not under the control of the client.

Withdrawals.

Withdrawals include those needed to provide for your living expenses (to supplement your employment or retirement income streams) and special amounts taken to pay for things like weddings, education, vacations, cars, real estate, etc. This variable is, within limits, under the control of the client.

Taxes and Inflation.

We estimate federal and state taxes, as well as general inflation rates and calculate their affects on your plan. This variable is circumstantial and not under the control of the client.

Investment Strategy.

A suitable investment strategy is key to your plan’s success. Our goal is to find the most conservative strategy that will meet your needs, thereby minimizing the amount of risk to which you’re exposed. Identifying the right strategy is a key function of the modeling process. This variable is, within limits, under the control of the client.

Investment Returns.

The modeling process varies the investment returns produced by the Investment Strategy and determines their affect on your plan. This variable is determined by the investment strategy selected for the Portfolio.

Lifespan.

Longevity, while attractive to most people, can place significant stress on a financial plan. It can lead to financial disaster when combined with bad luck in investing. Our modeling process accounts for longevity risk and seeks to insulate your from it. This variable generally not under the control of the client.

Ending Balance.

We can tailor your plan to include a target ending balance of any amount equal to, or greater than zero in your portfolio. We can then calculate your odds of your plan ending with a balance at or above this target, between your target and zero, and less than zero. This variable is, within limits, under the control of the client.