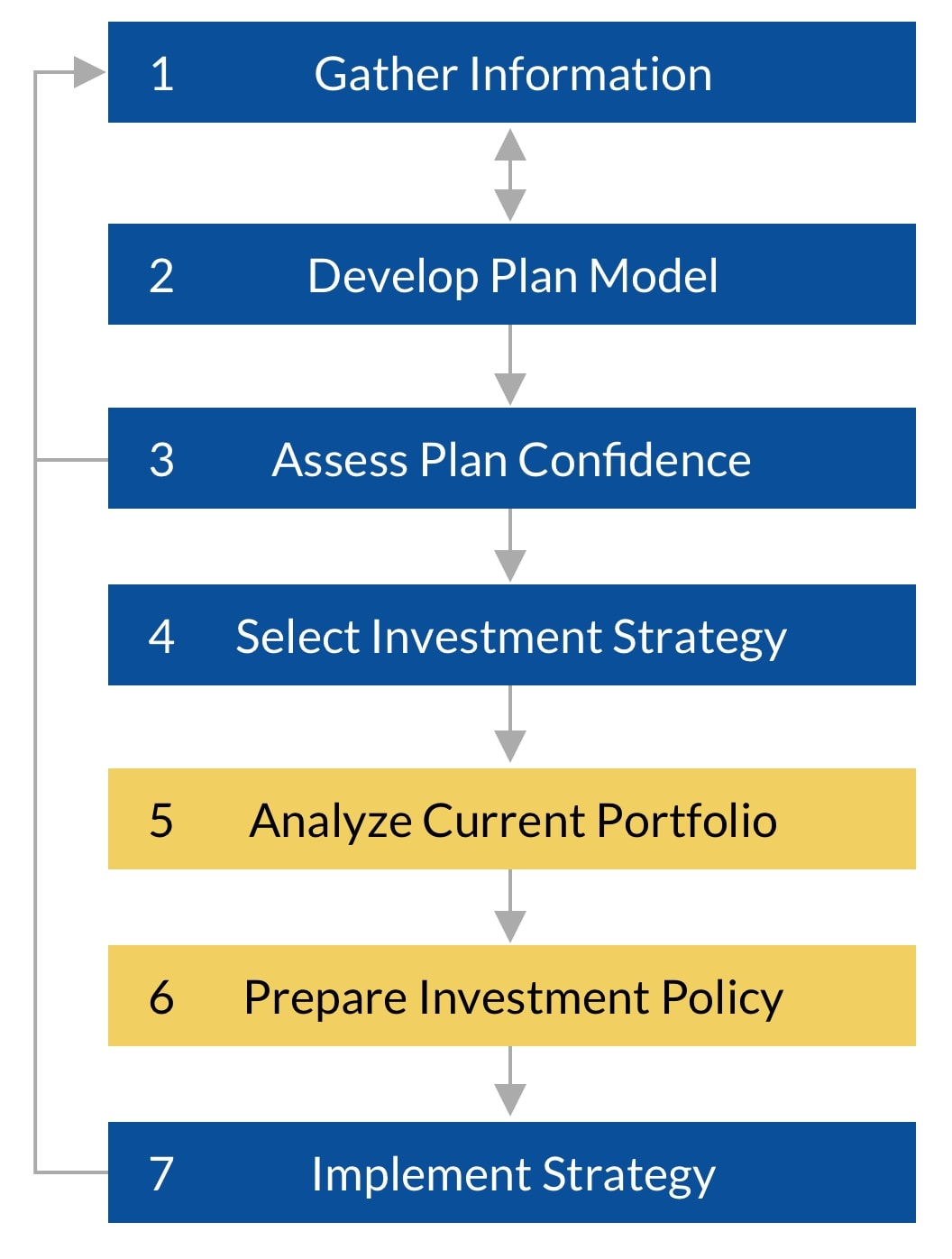

The Vantage Process

We have refined a seven-step process that serves as the basis for our Vantage™ engagement. This process is used to begin the relationship and again each time a review and update of your financial plan and investment portfolio is performed. The steps in blue involve significant amounts of client input, while the yellow steps are handled primarily or exclusively by Variplan.

You will note that at no time do we attempt to directly measure your “risk tolerance”. Rather than maximizing the risk you take, we determine and recommend the minimum risk necessary to confidently achieve your goals. It is your choice whether, for example, you would prefer to take more investment risk or spend less money in retirement to increase plan confidence to an acceptable level. There are often many ways to solve a problem with a plan, and we believe that it is our job to provide you with the support you need to choose the solution that is right for you. Each step is described in more detail below.

Gather Information.

The planning process begins with an assessment of your current situation and your financial and life goals. We use several information forms to request specific information. While a variety of information is required to complete a reliable analysis, we ask only for the information we will need. Following completion of our forms, we interact with you to make certain that we have a clear understanding of where you are and where you would like to be.

Develop A Plan Model.

We take the information we gather about you and use it to construct an interactive, computer based model of your financial life. This model uses powerful statistical algorithms (Monte Carlo Simulation) to simulate your financial future thousands of times over. During these simulations, the computer randomizes your mortality (and that of your spouse, if applicable) and the annual investment returns earned by your portfolio. The result is a determination of the likelihood that your plan will meet your needs under a wide range of possible circumstances.

Asses Plan Confidence.

The results of the modeling process will be presented, including the calculated plan confidence level and other statistics. This indicates how robust the plan is given the variables and uncertainty factored into the modeling. We set target ranges for plan confidence, usually 75% to 90% confidence (probability of success) is considered optimal. Our method helps you avoid unnecessary risk, as well as unnecessary sacrifice, and enables you to choose a plan that balances benefits and risk.

Select Your Investment Strategy.

Using the results of the modeling process, we help you to select the appropriate investment strategy from among our pre-configured alternatives. This is the strategy that, when combined with other variables in your plan (such as retirement age, savings contributions, portfolio withdrawals and tax rates) will yield an optimal probability of success.

Analyze Your Current Investment Portfolio.

Once the appropriate investment strategy has been selected, we analyze your current portfolio and determine how closely it matches the selected strategy. We consider such aspects as the number and type of accounts you hold, the costs incurred in these accounts, the types of securities you hold, their tax position and the asset allocation they produce. This process tells us how near or far your portfolio is from where it needs to be.

Prepare an Investment Policy Statement.

Based on the results of our portfolio analysis, we prepare a Portfolio Analysis and Rebalancing Recommendations report. This document explains the results of our analysis and provides detailed instructions for reconfiguring your portfolio, if necessary, to conform to the selected strategy. Special attention is paid to making this process as efficient and cost effective as possible. Our initial instructions may include consolidating or moving accounts as well as selling and buying specific securities.

Implement Your Investment Strategy.

Once your investment policy statement has been completed, the next step is to follow the instructions contained within it. This is done by the client, unless the account(s) have been placed under our management. In any event, you must approve of all actions prior to their execution. We offer support and guidance, as needed, to make this process as easy to complete as possible.